The Dark Side of Bitcoin: Illegal Activities, Fraud, and Bitcoin

The Dark Side of Bitcoin: Illegal Activities, Fraud, and Bitcoin

In mid-May, countless people across the world were attacked by a malware program that locked their computers and demanded money to unlock, in an attack dubbed WannaCry. The attackers received thousands of dollars in the form of Bitcoin. Bitcoin is anonymous and easy, which means its a favorite among criminals. Just how is Bitcoin used by criminals, how can you protect yourself from some Bitcoin scammers, and should Bitcoin face higher regulation to prevent criminals from being able to use the cryptocurrency? This article shall delve into the dark side of Bitcoin, and look at some of the negative aspects that present themselves.

OnMay 12 the WannaCry attack started in Europe. Using a malware software that exploited flaws in Windows security that was leaked from the NSA, the malware spread like wildfire, especially on May 15. Soon after the large spread on the 15th, a web researcher was able to drastically slow the attacks by discovering a kill switch. The malware locked a user out of their computer and demanded money payable in Bitcoin in order to unlock. Despite the quickness in slowing the attack, the attackers received thousands of dollars in Bitcoin.

The attack sparked renewed media interest in Bitcoin, arguably which helped spark the massive increase in price as I outline in a previous article, but it also caused many to question whether Bitcoin is too easy for criminals to use to receive their ill-gotten gains. An example of this is a strongly worded letter in Financial Times. The author argues that states work hard to limit illegal activity with state backed money, such as the EU outlawing 500 Euro bills, but do nothing to stop Bitcoin. She argues that Bitcoin and other cryptocurrencies have only allowed crime to grow, and have produced nothing else productive.

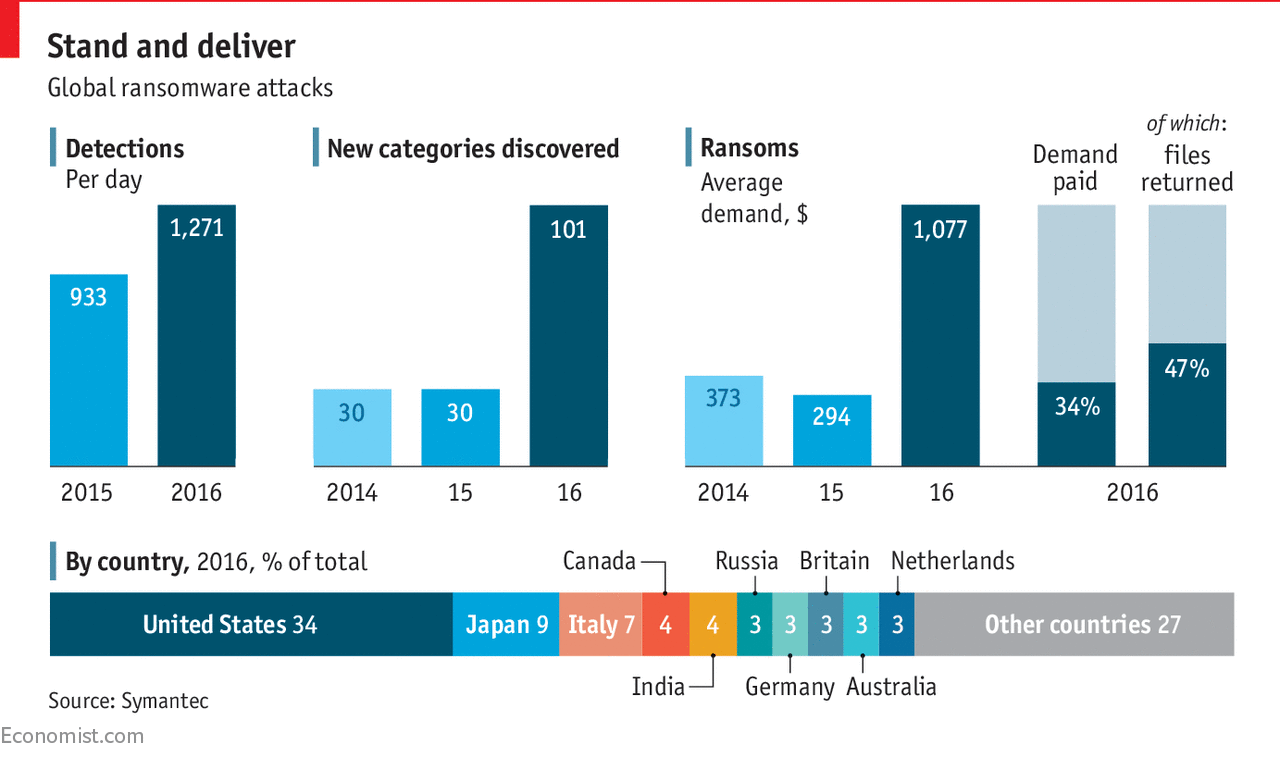

Now of course that is nonsense. Bitcoin shouldn’t be made illegal by nations just because it is used by criminals, just as cars or dollar bills shouldn’t be made illegal because they are used by criminals. Nevertheless, there is a point to be made that the anonymity of Bitcoin makes it a favorite among criminals. In fact, there has been an increase in ransomware attacks in recent years, as outlined in the graph below.

Arguably, Bitcoin has helped ransomware attacks, though the degree that Bitcoin can be blamed is up for debate. Internet and computer security is extremely weak, while hackers have been getting much more sophisticated, so it would make sense that attacks would rise. In addition, Bitcoin is not completely untrackable. Although there is no name attached to Bitcoin wallets, the wallets themselves, and transactions between wallets, are view-able to the public. This gives law enforcement the ability to track transactions and be able to make it easier to trace Bitcoin back to its owner, as was done in 2013 to arrest one of the largest drug markets that used Bitcoin. An interesting thing to note is that the WannaCry attackers haven’t removed the Bitcoin from the three wallets. This is likely because the attackers haven’t figured out how to launder the Bitcoin. Law enforcement would have an easier time of tracking down the perpetrators if the Bitcoin was moved or turned into another currency.

The WannaCry attack shows on a large scale one of the negatives of Bitcoin, its ability to be used by criminals to keep some anonymity in their illegal activities. Yet, Bitcoin still allows the movement of funds to be viewed by the public, so the cryptocurrency is not completely at the mercy of criminals. Bitcoin should be viewed as other currencies by states, they should attempt to limit illegal uses but not at the detriment of the legal users.

Bitcoin users can also be subject to theft, scams, and frauds, which some argue is made easier because of Bitcoin’s structure and lack of regulation. The very nature of Bitcoin makes fraud prevention hard, one of the biggest factors being there is no way to retrieve Bitcoin that has been stolen or conned, and no way to revert the transaction. This leads to sad stories like this one where a retired Maryland man was scammed of thousands of dollars.Scammers put a false car advertisement online, and told the perspective buyer to send them money using a Bitcoin ATM. There was no way to cancel the transaction when it was realized that it was a scam, and the Bitcoin were lost forever. Thankfully for the man, Bitexpress, the owner of the ATM, refunded his money and put software in place to freeze first time user transactions in the case of instances like these.

Nevertheless, as mentioned above, Bitcoin makes it easy for scammers to get their money and run. Once the money is transferred little can be done, as mentioned by this group of computer scientists. They argue that minor regulation of Bitcoin, although going against the idea of decentralization, could help prevent people from getting scammed. There is also the problem of no insurance in fraudulent activities. If fraudulent purchases are made with a credit card, the transaction can be cancelled, and often the bank will support you and insure you. With bitcoin, there is no way to cancel the transaction, and no central agency to insure against scams. Therefore, users must be able to protect themselves.

Using Bitcoin safely is a lot like using any form of payment system safely. Don’t give out private wallet keys to anyone, just as you wouldn’t give someone credit card. This Forbes article has a good outline of the various types of Bitcoin scams and how to avoid them. Because the majority of Bitcoin transactions take place online, basic internet safety should be used. Don’t click on suspicious links or emails. Also, only send Bitcoin to people or companies you trust. Small time scammers often use malware or phishing, that is pretending to be someone or something they are not. Such phishing attempts are things like websites that ask for your private key to show your wallet. It’s important to always remain vigilant.

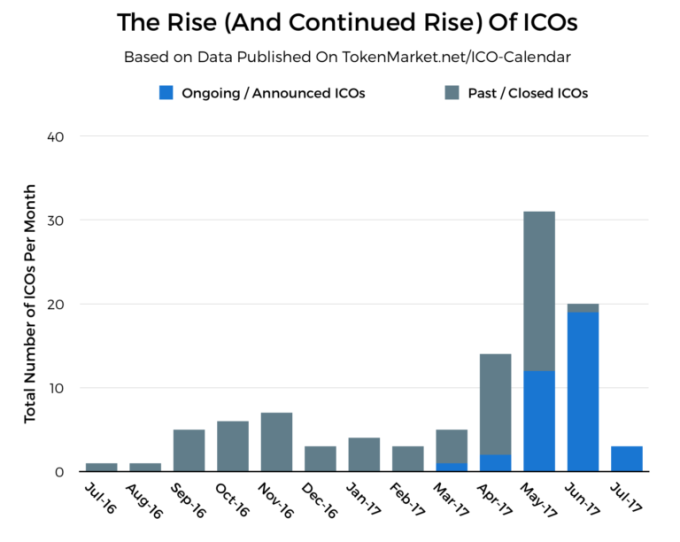

ICOs, or initial coin offerings, are used by people who want to start their own altcoins. This is an attempt to raise money through crowdfunding, like Kickstarter campaigns, in exchange for the new coins. Yet many of these crowdfunding attempts are scams, the scammer can run off with all the money with little to no accountability. There aren’t many legal guidelines so such ICO scams could potentially make off with little to no legal trouble. This is due to the fact that money back is not guaranteed. As with any investment, it can be expected that all your money could be lost, so scammers just claim the ICO failed and run off with the money.

One such concern is the Bancor project that is using Ethereum. There are some concerns being raised by cryptocurrency users that Bancor seems suspicious, but also that it could be used by scammers. Although the concerns don’t seem to say Bancor is a scam, it brings them under scrutiny. There is also a fake crowdfunding website claiming to be for Bancor, which further adds to the problems, and shows how easy it is to scam people out of money through cryptocurrencies.

Its very hard to tell which ICO is a scam or not. Again, common sense must play a role, don’t invest in something that you don’t trust. And there certainly are good ICOs out there that are worth an investment and may give quite a good return. Here is a good article that looks deeper at ICOs and how to prevent from getting scammed.

Even though Bitcoin can make it easier for criminals and scammers to perform their evil deeds, it still is a perfectly respectable and good investment and form of payment. Any form of currency has illegal users, Bitcoin is no different in this regard. The vast majority of users do use it legally, just as the vast majority use US dollars legally. That doesn’t mean one shouldn’t be vigilant when using Bitcoin, just as you should be careful on the internet or on the street. But don’t feel the need to shy away from it.

No comments: